Creating a comprehensive financial plan is crucial for the success and sustainability of any business. It involves analysing current and future costs and income to determine the best course of action. Effective financial planning enables businesses to allocate resources with confidence, manage cash flow efficiently, and make informed decisions about investments and growth opportunities.

A well-structured plan is not just beneficial for large corporations; it is equally vital for small businesses aiming to thrive in competitive markets. By having a clear financial plan, small business owners can improve decision-making, prepare for economic fluctuations, and enhance credibility with potential investors. This guide will walk you through a step-by-step process to create a robust plan that suits your business needs.

Understanding the Importance of a Financial Plan

Creating a comprehensive financial plan is a foundational step for small businesses aiming for success. A well-structured financial plan serves as a roadmap, guiding business decisions and helping owners understand their current financial position relative to their goals.

What Is a Business Financial Plan?

A business financial plan is a forward-looking projection of income and expenses, helping businesses anticipate financial needs and opportunities. It enables businesses to determine their cash flow, identify needs for financing, and decide when to take on new initiatives or projects. As stated by financial experts, “A financial plan is essential for monitoring financial health and progress, and for preventing potential problems.”

Why Financial Planning Is Critical for Small Business Success

Financial planning is critical for small business success as it improves cash management, prepares businesses for market changes, and enhances their ability to seize growth opportunities. Effective financial planning also helps businesses identify potential problems before they become critical, allowing for proactive management. As a result, financial planning contributes significantly to a business’s overall health and management, ultimately leading to long-term success.

By having a robust financial plan in place, small businesses can demonstrate fiscal responsibility and strategic thinking, thereby enhancing their credibility with lenders, investors, and potential business partners.

Essential Components of a Small Business Financial Plan

A well-structured financial plan is the backbone of any thriving small business, encompassing several critical components that work together to provide a comprehensive view of the business’s financial health.

Income Statement and Profit-Loss Projections

The income statement, also known as a profit-and-loss statement, details the profits and losses experienced during a specific time frame. It includes elements like cost of sales, revenue streams, operating expenses, and gross margin, providing insights into revenue, expenses, and overall profitability.

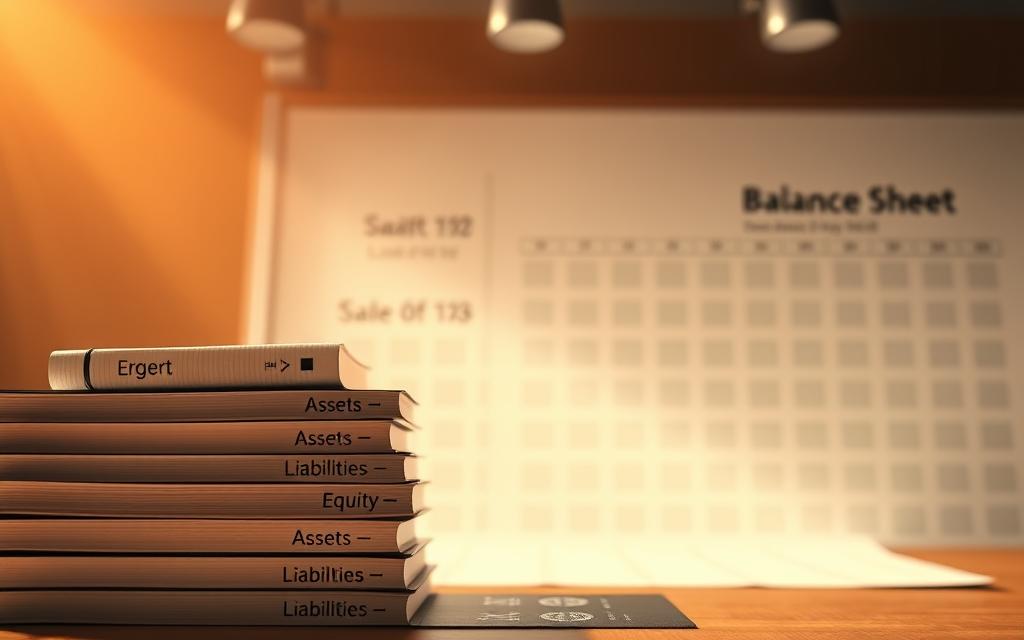

Balance Sheet Elements

A balance sheet provides a snapshot of the business’s financial position at a given time, documenting assets, liabilities, and owner’s equity. This helps in understanding the business’s financial standing and making informed decisions.

Cash Flow Projections

Cash flow projections are crucial for understanding how cash moves into and out of the business. They indicate the cash on hand, its allocation, sources, and scheduling of outflows, differing significantly from profit calculations.

Break-Even Analysis

The break-even analysis is a key indicator of financial health, measuring how much needs to be sold to cover expenses. It’s a vital tool for businesses to determine when they will start generating profits.

These components are interlinked, providing a complete picture of the business’s financial status and future prospects. Accurate and consistent preparation of these financial documents is essential for making informed decisions, such as investing in growth or seeking additional financing.

How to Make a Financial Plan for a Small Business

Crafting a financial plan tailored to your small business needs is a key factor in driving growth and profitability. A well-structured financial plan enables small businesses to navigate the complexities of the market, make informed decisions, and achieve their objectives.

Reviewing Your Strategic Business Plan

The first step in creating a financial plan is to review your company’s strategic plan. This involves assessing your business goals and objectives, identifying areas that require financial planning, and determining the resources needed to achieve your targets. You should ask yourself a series of questions: Do you need to expand your operations? Do you require additional equipment or staff? How will your plan affect your cash flow? Will you need financing, and if so, how much?

Developing Realistic Financial Projections

The next step is to develop realistic financial projections. This involves creating monthly financial projections by recording your anticipated income based on sales forecasts and anticipated expenses for labour, supplies, overhead, etc. It’s essential to strike a balance between optimism and pragmatism when forecasting revenue and expenses.

| Month | Projected Income | Projected Expenses | Net Profit |

|---|---|---|---|

| January | $10,000 | $8,000 | $2,000 |

| February | $12,000 | $9,000 | $3,000 |

| March | $15,000 | $10,000 | $5,000 |

Creating a Marketing Strategy

A compelling and effective marketing strategy is crucial for building a customer base and driving revenue growth. Your marketing plan should create messages, ads, promotions, emails, and other communications that spur action, address needs, and demonstrate value. By investing in marketing, you can increase your brand visibility and attract new customers.

Analysing the Competition

Understanding your competition is vital for making informed financial decisions. You should analyse your competitors’ pricing strategies, target markets, and market positioning. This information will help you plan financially and make informed decisions about your business.

- Identify your main competitors and their pricing strategies.

- Analyse their target markets and customer segments.

- Assess their market positioning and competitive advantages.

By following these steps and integrating them into a cohesive financial plan, you can ensure that your business is well-positioned for success. Remember to involve key team members in the planning process, document your progress, and review your plan regularly to make adjustments as needed.

Arranging Financing and Resource Allocation

Once you have a solid financial plan in place, it’s time to explore financing options for your small business. This involves determining your financing needs and approaching potential financial partners.

Determining Your Financing Needs

Use your financial projections to accurately determine your financing needs. Consider factors such as cash flow, operational costs, and potential investment opportunities. A thorough analysis will help you identify the amount of money required to achieve your business objectives.

Approaching Financial Partners and Investors

Approach your financial partners ahead of time to discuss your options. Well-prepared financial statements and projections will help reassure bankers that your financial management is solid. You can explore various financing options, including traditional bank loans, SBA loans, angel investors, venture capital, and alternative lending sources, as outlined on Smartsheet. Effective communication and a compelling business case are crucial in securing the necessary resources.

By carefully determining your financing needs and approaching financial partners with a solid plan, you can secure the resources required to drive your business forward.

Planning for Contingencies and Risk Management

Contingency planning is essential for small businesses to navigate through unforeseen financial challenges. It involves preparing for potential risks that could impact cash flow and overall financial health.

Building Emergency Funds and Credit Lines

One crucial aspect of contingency planning is building emergency funds to cover unexpected expenses. This can be achieved by allocating a portion of the business’s profits into a readily accessible savings account. Additionally, establishing a line of credit with a financial institution can provide a safety net during difficult times. It’s essential to negotiate favorable terms before emergencies arise.

Scenario Planning: Optimistic, Realistic, and Pessimistic Projections

Scenario planning involves creating financial projections under different scenarios: optimistic, realistic, and pessimistic. This helps businesses prepare for various market conditions and potential challenges. By anticipating different outcomes, businesses can develop strategies to mitigate risks and capitalize on opportunities.

To illustrate the importance of contingency planning, consider the following table that outlines the potential impact of different scenarios on a small business’s cash flow:

| Scenario | Projected Cash Flow | Potential Risks |

|---|---|---|

| Optimistic | £100,000 | Over-expansion, cash flow mismanagement |

| Realistic | £50,000 | Market fluctuations, delayed payments |

| Pessimistic | -£20,000 | Severe market downturn, significant losses |

By considering these scenarios, businesses can develop strategies to manage risks and ensure financial stability. Effective contingency planning enables businesses to respond promptly to challenges, minimizing potential losses.

Tools and Resources for Effective Financial Planning

Small businesses can significantly benefit from leveraging the right tools and resources for financial planning. Effective financial planning is the backbone of any successful business, enabling companies to make informed decisions, manage risks, and drive growth.

Accounting Software Options

Accounting software is a vital tool for small businesses, offering a range of functionalities from invoicing and expense tracking to financial reporting and analysis. Popular options include QuickBooks and Xero, which provide cloud-based solutions for managing finances efficiently. When selecting accounting software, consider factors such as scalability, user interface, and integration capabilities with other business systems.

Cloud-based accounting software offers the advantage of accessibility from anywhere, at any time, and typically includes features such as automated data backup and software updates. In contrast, desktop-based solutions may offer more control over data but require manual backups and updates.

When to Seek Professional Financial Assistance

While technology has made financial management more accessible, there are times when seeking professional financial assistance is invaluable. Small business owners should consider hiring financial professionals when they lack the expertise to create a comprehensive financial plan or need guidance on complex financial matters.

Financial professionals, including bookkeepers, accountants, and financial advisors, can provide expert advice tailored to the specific needs of the business. When selecting a financial professional, it’s essential to consider their qualifications, experience, and the services they offer.

In conclusion, leveraging the right tools and resources is crucial for effective financial planning in small businesses. By choosing appropriate accounting software and knowing when to seek professional financial assistance, businesses can ensure they are well-equipped to manage their finances and drive success.

Conclusion: Monitoring and Adjusting Your Financial Plan

To ensure the long-term sustainability of your business, regularly reviewing and adjusting your financial plan is essential.

Monitor your cash flow closely and compare actual results with projections to identify areas for adjustment.

Regular reviews will help you maintain financial discipline while adapting to changing business conditions.