Managing personal finances effectively is crucial for achieving long-term financial health and stability. It encompasses various aspects, including saving, investing, budgeting, and retirement planning, all of which are vital for making the most of your income and savings.

A well-planned financial strategy enables you to make informed decisions about your money, reducing financial stress and securing your future. It’s not just about accumulating wealth; it’s about creating a balanced approach to handling finances that aligns with your values and life objectives.

By understanding the fundamentals of personal finance, you can take control of your financial situation and build a solid foundation for long-term wellbeing.

Understanding Personal Finance and Its Impact

Managing your personal finances is essential for securing your financial future. Understanding your financial situation helps you make informed decisions about your money, enabling you to achieve your financial goals.

What Personal Finance Encompasses

Personal finance encompasses a broad range of financial activities, including budgeting, saving, investing, insurance, mortgages, banking, taxes, retirement planning, and estate planning. At its core, it is about making deliberate choices with your money that align with your short-term needs and long-term aspirations. Effective financial planning provides a framework for maximising your income potential and creating pathways to achieve significant life milestones.

How Financial Decisions Affect Your Life

Financial decisions, both large and small, have cumulative effects that significantly impact your quality of life, from your daily comfort to your long-term security. The impact of these decisions extends beyond numbers in an account—they influence your stress levels, opportunities, and overall life satisfaction. Understanding the fundamentals of personal finance empowers you to develop a healthier relationship with money and make more informed financial choices.

Why Is It Important to Manage Your Personal Finances Correctly

Proper personal finance management is the cornerstone of a stress-free and secure financial future. By taking control of your financial situation, you can mitigate potential risks and make informed decisions that impact your overall well-being.

Financial Security and Stability

Managing your finances effectively creates a foundation for long-term financial security and stability. This, in turn, protects you and your family from economic uncertainties, providing a safety net during unexpected events such as job loss or medical emergencies.

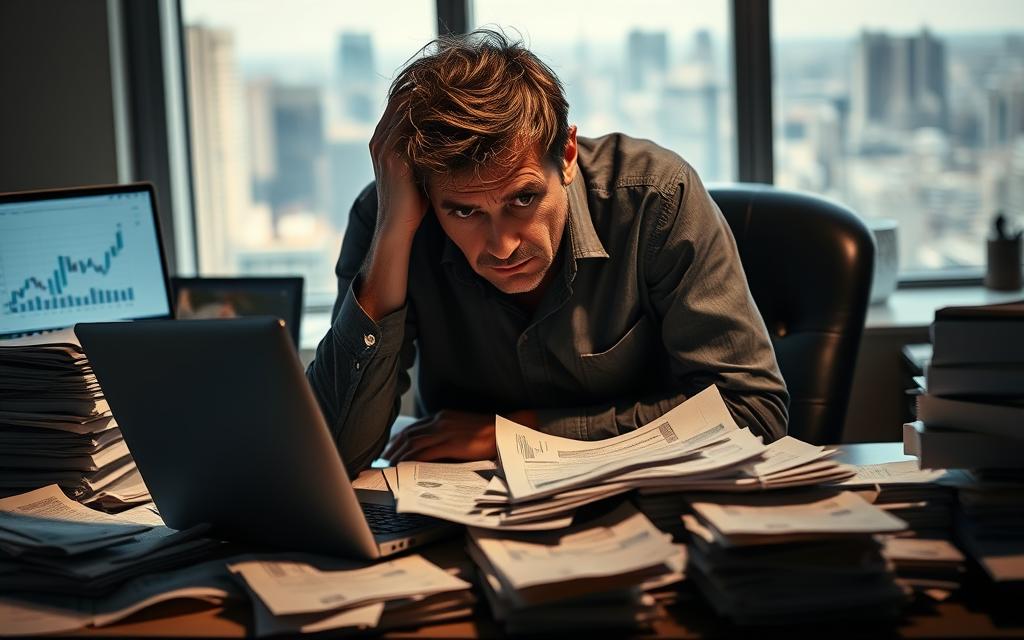

Reduced Stress and Anxiety

An uncertain financial future can lead to significant stress and anxiety. In fact, research indicates that 90% of Americans experience financial stress, which can manifest in physical symptoms like sleep difficulties and headaches. Working with a financial advisor can help alleviate this stress, with 83% of individuals reporting reduced financial stress after seeking professional help.

Greater Control Over Your Future

By managing your finances correctly, you gain greater control over your financial destiny. This enables you to make proactive decisions, rather than reacting to financial challenges as they arise. As a result, you can pursue meaningful life goals and experiences without the burden of financial worry, ultimately securing a brighter future.

| Benefits of Managing Personal Finances | Description |

|---|---|

| Financial Security | Protects against economic uncertainties |

| Reduced Stress | Alleviates financial anxiety and related physical symptoms |

| Greater Control | Empowers proactive financial decision-making |

The Five Core Principles of Financial Literacy

Financial literacy, which involves understanding how to manage your money, is based on five core principles. According to the National Financial Educators Council, financial literacy is the ability to understand the use of money as it applies to your personal finances. It can help you make better decisions and is a key element in improving your behaviour and planning when it comes to your personal finances and overall financial wellness.

These five principles work together to form the foundation of sound money management. They guide responsible financial decision-making and help individuals achieve financial stability.

Earning and Income Management

Earning and income management involves maximising your income potential and understanding how to effectively utilise workplace benefits like retirement plans with employer matches. Effective income management is crucial for achieving financial stability.

Saving and Investing

The saving and investing principle focuses on growing wealth over time through consistent contributions to various investment vehicles. This helps you prepare for major life expenses and retirement, ensuring a more secure financial future.

Borrowing and Debt Management

Borrowing and debt management teaches responsible use of credit, understanding interest rates, and developing strategies to minimise high-interest debt while leveraging beneficial forms of credit. Managing debt effectively is vital for maintaining financial health.

Spending and Budgeting

Spending and budgeting principles help you track expenses, prioritise needs over wants, and create sustainable spending plans that align with your financial goals. Effective budgeting is essential for achieving financial stability and reducing financial stress.

Protecting Your Assets

The protecting assets principle emphasises safeguarding your financial resources through appropriate insurance coverage, emergency funds, and estate planning. Protecting your assets ensures that you are prepared for unexpected events and can maintain your financial well-being.

By understanding and applying these five core principles, individuals can achieve a balanced approach to financial literacy, ultimately leading to improved financial health and stability.

Building a Solid Financial Foundation

A solid financial foundation is the cornerstone of effective financial planning. It enables individuals to navigate financial challenges and make progress towards their long-term goals. This foundation is built on several key components, including an emergency fund, debt management, and a good credit score.

Creating an Emergency Fund

An emergency fund is a crucial safety net that covers 3-6 months of essential expenses. It should be kept in an accessible savings account, separate from regular spending accounts to prevent impulsive use. Experts recommend saving up at least three to six months’ worth of expenses to draw upon in case of a sudden incident.

Managing and Reducing Debt

Managing debt effectively requires distinguishing between productive debt, such as mortgages or education loans, and high-interest consumer debt. Strategic debt reduction approaches include the avalanche method, focusing on the highest interest rates first, and the snowball method, paying off the smallest debts first for psychological momentum.

Understanding Your Credit Score

Understanding your credit score is essential as it impacts your ability to secure favourable loan terms, rental agreements, and sometimes even employment opportunities. Regular monitoring of your credit report allows you to identify and address errors or fraudulent activity that could negatively impact your financial foundation.

| Financial Component | Description | Benefits |

|---|---|---|

| Emergency Fund | Savings covering 3-6 months of expenses | Provides a safety net for unexpected expenses |

| Debt Management | Distinguishing between productive and high-interest debt | Reduces financial stress and saves on interest |

| Credit Score | A measure of creditworthiness | Influences loan terms, rental agreements, and employment opportunities |

A strong financial foundation provides stability that enables more advanced financial planning and wealth-building strategies. By focusing on creating an emergency fund, managing debt, and understanding your credit score, you can establish a robust financial base that supports your long-term financial health.

Effective Budgeting Strategies

A well-planned budget helps in allocating resources efficiently. Effective budgeting serves as the cornerstone of financial management, providing a clear framework for allocating your money purposefully rather than wondering where it went.

Tracking Income and Expenses

Tracking income and expenses involves systematically recording all financial transactions, which creates awareness of spending patterns and identifies areas for potential savings.

The 50-30-20 Budget Method

The 50-30-20 budget method offers a straightforward approach by allocating 50% of income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment.

Tools and Apps for Budget Management

Modern budgeting tools and applications have transformed financial tracking, offering features like automatic categorisation, spending alerts, and visual reports that simplify money management. Popular budgeting apps include Mint, YNAB (You Need A Budget), and PocketGuard.

Consistent budget reviews and adjustments are essential as income, expenses, and financial goals evolve over time.

Setting and Achieving Financial Goals

Establishing financial goals provides direction for your financial planning efforts, transforming abstract aspirations into concrete, achievable objectives. To set financial goals, start by distinguishing between short-term and long-term objectives.

Short-term vs Long-term Financial Goals

Short-term financial goals typically span 1-3 years and might include building an emergency fund, paying off credit card debt, or saving for a holiday. In contrast, long-term financial goals extend beyond 3-5 years and often encompass major life milestones such as homeownership, funding children’s education, or retirement planning.

| Goal Type | Timeframe | Examples |

|---|---|---|

| Short-term | 1-3 years | Emergency fund, paying off credit card debt, saving for a holiday |

| Long-term | Beyond 3-5 years | Homeownership, funding children’s education, retirement planning |

SMART Goal Framework for Finances

The SMART framework ensures goals are Specific, Measurable, Achievable, Relevant, and Time-bound, increasing the likelihood of successful implementation. By applying this framework, you can create clear and actionable financial goals.

For instance, instead of saying “I want to save money,” a SMART goal would be “I will save £10,000 for a down payment on a house within the next 2 years.”

Monitoring Progress and Adjusting Plans

Regular monitoring of progress toward financial goals allows for timely adjustments to strategies and approaches as circumstances change. Breaking larger financial goals into smaller milestones creates opportunities to celebrate progress, maintaining motivation throughout the journey.

By following these steps and maintaining a disciplined approach, you can effectively achieve your financial goals and improve your overall financial health.

Investing for Your Future

The key to a financially stable future often lies in making informed investment decisions. When you invest your money, it’s essential to have a clear financial goal in mind. Most people invest for retirement, but others invest for specific purposes like buying a home or paying for their children’s education.

Basic Investment Principles

Basic investment principles include starting early, investing consistently, understanding risk tolerance, and recognising that time in the market typically outperforms timing the market. By adopting these principles, you can make informed decisions that help your investments grow over time.

Retirement Planning Essentials

Retirement planning essentials involve calculating your retirement needs based on desired lifestyle, expected longevity, and inflation considerations. Employer-sponsored retirement plans, such as 401(k)s, offer significant advantages, particularly when employer matching contributions are available.

Diversification and Risk Management

Diversification—spreading investments across different asset classes, sectors, and geographical regions—helps manage risk by ensuring that poor performance in one area doesn’t devastate your entire portfolio. Risk management in investing involves balancing potential returns against your personal risk tolerance and time horizon.

By understanding and implementing these investment strategies, you can work towards securing a more financially stable future.

Common Financial Mistakes to Avoid

A vital component of financial planning involves understanding and avoiding typical financial missteps. Being aware of these common pitfalls can help individuals steer clear of financial difficulties and achieve stability.

Credit Card Debt Traps

Credit card debt is a prevalent issue, often resulting from overspending, making only minimum payments, and carrying high-interest balances. To avoid this trap, it’s essential to stay within your budget and pay off your balance in full each month. Automating your payments can also help prevent missed payments and additional interest charges.

- Be mindful of your spending habits to avoid accumulating debt.

- Pay more than the minimum payment to reduce your balance quickly.

Neglecting Emergency Savings

Neglecting to build emergency savings can leave you vulnerable to unexpected expenses, forcing you to rely on high-interest debt. Studies indicate that a significant portion of adults struggle to cover unexpected expenses without borrowing. Building an emergency fund can provide a crucial safety net.

Failing to Plan for Major Life Events

Major life events, such as marriage, having children, or purchasing a home, carry significant financial implications. Proactive planning for these events can help mitigate financial stress. It’s also essential to review and adjust your financial plans as circumstances change.

Conclusion: Taking Control of Your Financial Health

Embracing a proactive approach to financial planning can lead to a more stable and fulfilling life. By committing to ongoing education and applying sound financial principles, you can achieve significant positive outcomes over time.

Implementing the strategies outlined in this guide provides a comprehensive framework for managing your personal finances effectively. This includes building emergency savings, investing wisely, and maintaining a highly personalised approach to financial management that aligns with your unique circumstances and aspirations.

By taking control of your finances today, you’re investing in a more secure future for yourself and your loved ones. Regular attention to your financial health and management will yield dividends in reduced stress and increased opportunities.